By Sarah Allen

Real estate coordinator, homeowner, and human navigating life’s plot twists

The other day, I was talking to my dad about housing prices. He bought his first home in Oakville back in the ’70s for $54,000.

That same house recently sold for over a million.

I bought my place in Nova Scotia 10 years ago for $160,000. I’m about to sell, and it’ll likely go for around $450,000. Not bad, right?

But here’s what’s been nagging at me lately: I have three adult kids. And honestly? I have no clue how they’re ever going to afford a home of their own.

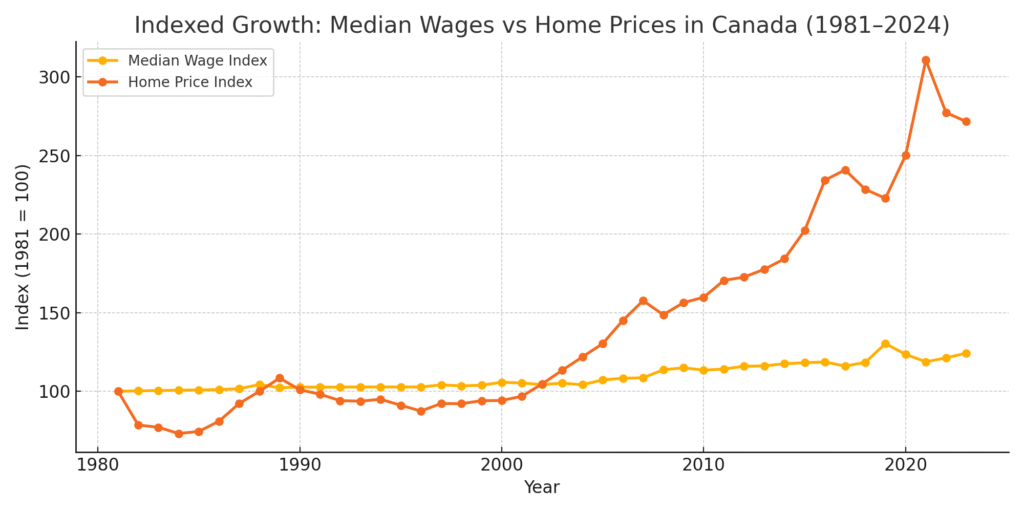

A new report from Stats Canada spelled out what a lot of us have already felt: home prices in Canada have grown nearly seven times faster than wages since 1981.

Wages for full-time jobs? Up 24% over 40+ years.

Home prices? Up more than 160%.

So no, it’s not in anyone’s head. The math just doesn’t work the way it used to. People aren’t being dramatic—they’re being realistic. You can work hard, save smart, and still feel like you’re standing still.

And if you missed it, I touched on this in Homeownership? Not Without Help, Says Nearly Half of Canadians, where it’s clear that even those who do manage to buy often need financial help to make it

If you already own a home, your equity’s probably looking great on paper. That’s the upside.

But what happens when it’s time to sell, and the next generation can’t afford to buy?

There’s this tension nobody really talks about. We want prices to stay high because, let’s be honest, it helps us. But high prices mean our kids—and lots of other people—are left out completely. At some point, the system has to reckon with that.

I don’t have a tidy answer. But maybe the problem isn’t just the housing market.

Yes, prices are high—but maybe the real issue is that wages haven’t kept up. People are working hard, doing everything right, and still falling behind. That’s not sustainable.

Maybe it’s not about cutting back or saving smarter. Maybe it’s about companies stepping up—and the system catching up.

Because if the next generation can’t afford to buy, and the current one can’t afford to retire, something’s got to give.

share this: